Commentary

"Government" is Becoming a Joke

There are two headlines on Drudge today that caught my eye. The first one is "Diappointment in Obama leads some blacks to ask: Is voting even worth it?"

Why "media" continues to divide the world according to skin color is beyond me, but that is not my point today. I take this headline as confirmation of what I have believed for a while now, that voting in our "elections" is a waste of time.

The other headline is "Republicans Rush Obamatrade Before Public Reads It." This seems to be more confirmation of point one. There are also headlines that claim polls show most people oppose new Obama trade powers.

Yesterday there was a story about the government's secret court, which hears cases about government surveillance. According to the story the government was not happy about a ruling a "public" court made regarding mass surveillance and so, they brought their case to the secret court, which had more "expertise" in the issue.

If these stories are true, I see the government as just another tyrant that does what is reasonable to it and disregards the law. If that is correct there is no rule of law and "elections" are pointless. It also renders the "news" pointless, because there won't be much you can do in response to it.

A definition of the word Torah

- T

- Teaching

- O

- Others

- R

- Relentlessly

- A

- About

- H

- HaShem

What is the big deal about keeping Shabbat on the seventh day?

The answer to the question depends entirely on you. It depends on who you are and/or who you want to be.

Genesis 2:2 says this:

And God completed on the seventh day His work that He did, and He abstained on the seventh day from all His work that He did.

Who are you and who do you want to emulate?

Some argue that Shabbat can be kept on another day of the week as long as the seven day cycle is maintained. You could do that, but then you are not in sync with HaShem and His schedule.

Rabbi Nosson Scherman wrote "An Overview / Prayer and the Holy Days" in the Schottenstein Edition of a "Siddur For The Sabbath and Festivals". He pointed out a distinction between Sabbath and the Festivals. He wrote the Sabbath was ordained by G_d and it comes every seventh day irrespective of what man does. It comes and goes each and every seventh day whether man observes it or not. The Festivals on the other hand are dependent on the Jewish calendar. Men have to observe the sun, moon and stars and determine the month and the day. The determination has to be made in order to know when the festival arrives. This also shows the spiritual power that man has been given by HaShem. See Vayikra (Leviticus) Chapter 23:

2. Speak to the children of Israel and say to them: The Lord's appointed [holy days] that you shall designate as holy occasions. These are My appointed [holy days]:

3. [For] six days, work may be performed, but on the seventh day, it is a complete rest day, a holy occasion; you shall not perform any work. It is a Sabbath to the Lord in all your dwelling places.

4. These are the Lord's appointed [holy days], holy occasions, which you shall designate in their appointed time:

Recognizing Shabbat on the seventh day is a recognition of HaShem, His power and His creation in the first six days.

Keeping the Sabbath is also giving testimony. It is giving testimony as to who and what is HaShem. It is testimony that He is G_d and that He created the world.

Vayechulu is the three-verse passage (Genesis 2:1-3) recited in the Friday evening prayers and kiddush. It recounts G-d's creation of the world in six days, His cessation of work on the seventh, and His sanctification of the seventh day to attest to these facts. By reciting Vayechulu, we observe the mitzvah to "Remember the day of Shabbat, to sanctify it" (fourth of the Ten Commandments, Exodus 20:8); the pronouncement of Vayechulu, corroborated by our cessation of work on Shabbat, is our weekly testimony that G-d is the creator of the universe.[8]See "A Box of Life".This is in keeping with the prophet's proclamation, " `You are My attesters,' says G-d."[9] And this, the Talmud is saying, is the essence of our partnership with G-d: our introducing an awareness of His truth into the spiritually mute world He created.

If you are with Him, who can stand against you?

Again, it comes down to you and who you want to be. Enough said.

David Stockman on the Warfare State - March 19, 2014

Have you ever wondered why a monopoly on the issuing of money is so dangerous? Granting such a monopoly grants almost unlimited power. Power to wage war and cause death and destruction. David Stockman explained here why the Fed is so dangerous and how it frees the government from responsibility. See it here.

What would vary dramatically, however, was the free market interest rate in response to shifts in the demand for loans or supply of savings. In general this meant that investment booms and speculative bubbles were self-limiting: When the demand for credit sharply out-ran the community's savings pool, interest rates would soar-thereby rationing demand and inducing higher cash savings out of current income. This market clearing function of money market interest rates was especially crucial with respect to leveraged financial speculation-such as margin trading in the stock market. Indeed, the panic of 1907 had powerfully demonstrated that when speculative bubbles built up a powerful head of steam the free market had a ready cure.If the government borrowed consistently due to deficit spending, interest rates would go up and make it difficult for average people to get a loan. Here is more from Mr. Stockman:

Needless to say, these very same free market interest rates were a mortal enemy of deficit finance because they rationed the supply of savings to the highest bidder. Thus, the ancient republican moral verity of balanced budgets was powerfully reinforced by the visible hand of rising interest rates: deficit spending by the public sector automatically and quickly crowded out borrowing by private households and business.And this brings us to the Rubicon of modern Warfare State finance. During World War I the US public debt rose from $1.5 billion to $27 billion-an eruption that would have been virtually impossible without wartime amendments which allowed the Fed to own or finance U.S. Treasury debt. These "emergency" amendments-it's always an emergency in wartime-enabled a fiscal scheme that was ingenious, but turned the Fed's modus operandi upside down and paved the way for today's monetary central planning.

As is well known, the Wilson war crusaders conducted massive nationwide campaigns to sell Liberty Bonds to the patriotic masses. What is far less understood is that Uncle Sam's bond drives were the original case of no savings? No credit? No problem!

What happened was that every national bank in America conducted a land office business advancing loans for virtually 100 percent of the war bond purchase price-with such loans collateralized by Uncle Sam's guarantee. Accordingly, any patriotic American with enough pulse to sign the loan papers could buy some Liberty Bonds.

And where did the commercial banks obtain the billions they loaned out to patriotic citizens to buy Liberty Bonds? Why the Federal Reserve banks opened their discount loan windows to the now eligible collateral of war bonds.

Additionally, Washington pegged the rates on these loans below the rates on its treasury bonds, thereby providing a no-brainer arbitrage profit to bankers.

Through this backdoor maneuver, the war debt was thus massively monetized. Washington learned that it could unplug the free market interest rate in favor of state administered prices for money, and that credit could be massively expanded without the inconvenience of higher savings out of deferred consumption. Effectively, Washington financed Woodrow Wilson's crusade with its newly discovered printing press--turning the innocent "banker's bank" legislated in 1913 into a dangerously potent new arm of the state.

The Fed created an enormous bubble by lending Europe money after World War I. Those loans were spent on American goods and created a big export boom here in the U.S. The boom led to borrowing and ballooning prices here, but that all crashed with the Depression.

Thus, the Great Depression was born in the extraordinary but unsustainable boom of 1914-1929 that was, in turn, an artificial and bloated project of the warfare and central banking branches of the state, not the free market.You may have thought the Fed was created to prevent bubbles and crashes. The Fed does not prevent them, it creates them.

You are seeing this pattern being repeated, except we are now in the place of Europe and China is now in our former position.

To inifinty and beyond!

Another Dip for U.S. Housing - March, 9, 2014

If you think the housing market has recovered or is recovering, you might want to read this article:

"(Reuters) - U.S. borrowers are increasingly missing payments on home equity lines of credit they took out during the housing bubble, a trend that could deal another blow to the country's biggest banks. The loans are a problem now because an increasing number are hitting their 10-year anniversary, at which point borrowers usually must start paying down the principal on the loans as well as the interest they had been paying all along. More than $221 billion of these loans at the largest banks will hit this mark over the next four years, about 40 percent of the home equity lines of credit now outstanding. For a typical consumer, that shift can translate to their monthly payment more than tripling, a particular burden for the subprime borrowers that often took out these loans. And payments will rise further when the Federal Reserve starts to hike rates, because the loans usually carry floating interest rates."

Remember to buy the dip.

To infinity and beyond!

Ben Bernanke Revealed In One Word Why The System Crashed In 2008 - March 5, 2014

Chairman Ben has retired and now can speak freely. I remember seeing him in an interview on 60 Minutes and my impression was of a nervous man that was bluffing and I remember thinking that he did not make a good banker, because bluffing is what bankers mostly do.

To find out the one word that described why the "system crashed", you can follow this link: Bernanke Revealed Why "System" "Crashed" in 2008.

Apparently Ben regrets that the Fed did not do more, as if $3.3 trillion was not enough.

To infinity and beyond!

"Stopping the Keynesian Death March" - 03/27/13

I read part of this article today entitled, "Stopping the Keynesian Death March".

"In a previous Circle Bastiat post, I highlighted Rothbard's recommendations for reducing deficits. The two major points were: 1. "While deficits are often inflationary and always pernicious, curing them by raising taxes is equivalent to curing an illness by shooting the patient."2. "Deficits, then, should be eliminated, but only by cutting government spending."

In "Escape From Spending Hell" (Wall Street Journal,March 14, 2013), Daniel Henninger discusses recent work on austerity programs by Harvard economist Alberto Alesina (with Carlo Favero and Francesco Giavazzi) that provides strong historical support for Rothbard's points.

Henniger summarizes the current problem and possible policy options as follows:

Ever since Ronald Reagan legitimized the efficacy of tax cuts, Democrats have sought to discredit his idea and restore the New Deal theory of a Keynesian multiplier, which dates to 1931. It holds that more public spending will revive a struggling economy.

No president has believed more in the miracle of the multiplier than Barack Obama. Across four years he has led the country on a kind of Keynesian death march, pushing federal spending to 25% of GDP and producing weak growth. We're looking at four more years before the Keynesian mast unless the Republicans can offer an intellectually respectable alternative."

This is the usual debate about how to "improve" the "economy". Is it done by cutting taxes or by government deficit spending?

As far as I can tell there can only be one reason for this debate and that is a misunderstanding of money. It seems that most people perceive money as "wealth". This is incorrect. Wealth are the things for which the money is traded - food, clothes, houses, entertainment, energy.

I think once that idea hits home, it becomes obvious why deficit spending and tax increases will fail. Deficit spending and tax increases both discourage entrepreneurs from producing and creating real wealth.

Another effect of this idea hitting home will be the producer's evaluation of the money itself. A producer of real wealth should be very reluctanct to accept cheap, counterfeit, paper fiat currency in exchange for his/her real wealth. The only reasons that cheap, counterfeit, paper fiat currency trades at all is the government has granted a monopoly over its production to the Federal Reserve system and demands that its taxes be paid with it.

Two things need to happen to "stimulate" the "economy":

1) Let the free market decide what commodity or commodities are money

2) Cut government taxation and regulation.

The action of the free market will lead to sound money(ies) and cutting government regulation and taxation will encourage producers to produce. We should get stable money and increasing competition among producers to obtain it. Those two things will lead to better quality and lower prices.

Everyone that is willing to work for his/her bread and butter will be happier and wealthier. The only ones that will be unhappy are those looking for a handout.

Mike Norman on Alan Simpson - 12/6/12

Mr. Norman claimed if the media can't call guys like Alan Simpson out on these baseless claims, they are worthless. The article by Mr. Norman can be found here.Mr. Norman apparently believes that money grows on trees or he is admitting that it is worthless - like points in a video game or at a bowling alley.

Here is most of the article with my comments:

Former Senator Alan Simpson gave an interview on the Today Show this morning and here are a few comments he made. "There's people that we owe $16 trillion bucks to. We're in deficit to the tune of $1 trillion one hundred million. If that isn't a stimulus then the drinks are on me." "Unless you get in there these people are going to say, I got an idea for you...you're addicted to debt, and we're gonna loan you more and we want more money for our money and then when we do that interest rates will kick up and inflation will kick in..."First off the gov't owes about half of that $16 trillion to itself, so let's just correct him right off the bat and by the way, why doesn't he make that clear? The answer is, because it's part of his campaign to manipulate you. He has no leverage if you're not scared.

Me: Government owes itself $8 trillion? Really? Why not cancel that $8 trillion now? Could it be that it is owed to the SS Trust Fund and the Medicare Trust Funds? How would people dependent on those Funds feel about the cancellation?

Next he says we're in a deficit to the tune of $1.1 trillion. And he says, "if that's not a stimulus then the drinks are on me." Ok, I'm confused here. Is he agreeing that the deficit is a stimulus?

Me: Deficit is stimulus. That is the Keynesian claim. $1 trillion deficit is unprecedented. Where is the stimulus effect forecast by Keynes?

Moving on he's saying that we owe money. Let's get real...WE owe nothing. WE got paid, in dollars. That's what we OWN not owe. Dollars. That's it. The world (including parts of our own government) got to keep $16 trillion dollars because in the past 234 years that's the amount of dollars the gov't spent into the economy in excess of what it took away from us in taxes.

Me: $16 trillion "spent into the economy". A more accurate statement: "$16 trillion printed into the economy." Government does not work for money. It prints Treasuries. They are either monetized by the Fed (money was just printed or credited to government checking account) or sold to other investors who already had dollars. Other investors expect to get their money back plus interest.

Those people/nations/institutions...whatever...are holding those dollars in dollar equivalents called Treasuries, just like you holding your money in a savings account at your bank. How does the bank "pay you back?" It debits your savings account and credits your checking account. That's it. Done. Just like that. Nobody screaming where's the bank gonna get the money to pay you back? Nobody saying the bank has to go on austerity in order to be able to move your money from your savings account to your checking account. The bank just makes some accounting changes and your savings account balance goes down and your checking account balance goes up. Same thing with how we "pay back" holders of Treasuries.

Me: This is a good admission of just how worthless dollars are today. Let us accept the statement "holding those dollars in dollar equivalents called Treasuries." Why don't we just face the fact that "dollars" are nothing, but IOU's? Why not skip the Treasury step altogether? We know that no work was performed to obtain the Treasuries. Treasuries are simply converted to dollars when the Fed buys them, but the reverse does not happen. The dollars that are used to pay off the Treasuries are earned by actual work, sweat, blood, time and then taxed away from the workers that earned them to pay those that hold the Treasuries.

The Fed just debits their securities account (at the Fed) and credits their reserve account (also at the Fed). In fact this has been done to the tune of $11.6 trillion so far this fiscal year alone. We're talking two and a half months! In that time the national debt has been almost completely rolled over (paid back).

Me: "Rolled over" equals "paid back"? The last I knew "rolled over" meant re-financed - not "paid back". It means the debt is still owed - the payment has just been postponed.

Let's keep going. Simpson says people are loaning us the money because we're addicted to debt. So, who is loaning us money? What money? Dollars? Here's a simple question for Alan that the interviewer should have asked: If we make the money, which we do, why do we need to borrow it? Where is that person who is lending it to us, getting it from? I guarantee you, he won't be able to answer that.

Me: "Why do we need to borrow it?" Good question. Why don't you ask Ben Bernanke? Maybe he will tell you it is "tradition" - like holding gold for reserves.

As for the charts showing declining interest rates and low CPI - ask Ben again. What Fed policies are encouraging, if not forcing, banks not to lend?

Election 2012

This is to the two candidates for the office of President this year. As far as I am concerned it makes absolutely no difference which one of you is elected. We will wake up the morning after and our lives will continue as before. Even as the winner nears the end of the next term, no difference will be visible. Therefore, I will not be voting in this election. You can stop sending your propaganda my way. Thank you.

No Third Term For The Chairman

We read today in Zero Hedge Chairman Ben Bernanke plans to retire from the Federal Reserve in 2014. This job is arguably the most powerful job in the world because it puts you in charge of U.S. monetary policy. It can't be a hard job. He is only 58. He will be just 59 when he retires. Why would he want to leave so early?

There could be at least two reasons. One is he fears that Mitt Romney will win the Presidential election and that Mr. Romney will not re-appoint him and he wants to save himself some embarassment. The other is that 2015 is a shmitta year and at this point it looks like the Fed will be sitting on a balance sheet of $5 trillion by then. It will be impossible to unwind. Shmitta means release. God calls us to have a sabbath in the shmitta year. God allows us to go our own way up to a point and in the end He forces us to go His way.

My money is on a fearsome release occurring in 2015. $5 trillion dollars. That will be like a full septic tank building pressure. When it lets go, it will not be pretty. Could that be the reason for Mr. Bernanke planning to retire in 2014?

The government wants to "help" you with money for later in your life

New Rules for annuities in 401k's

Near the top of the article is the statement that the Obama administration wants to "help" workers manage longevity risks. Yes. Please let me "help" you by allowing you to lend me money for a hamburger today!

Turbo Tax Timmy needs to borrow money:

"When American workers take the responsible step of saving for retirement, we should do all we can to provide them with sensible, accessible choices for managing their hard-earned savings. Having the ability to choose from expanded options will help retirees and their families achieve both greater value and security," said Treasury Secretary Tim Geithner, in a press release.

Is anyone up for lending the government money? I am sure you will receive a pittance in interest.

This is a simple con game. Mr. Geitner wants American savers to plow money into annuities, which in turn will purchase Treasury bonds. The government will eventually print money to pay those bonds. The savers will have everything inflated away from them.

If you think the bond market bubble won't burst, think real estate. No one thought that would go down either.

They are also hoping you die before they have to pay you back:

According to the Treasury Department, currently some employers and IRA providers are hesitant to offer such annuities in part because retirees must count the dollars they use to purchase this type of annuity when they go to calculate their required minimum distributions, or RMDs, from their tax-deferred retirement plans - even though those dollars are essentially locked away in the annuity and they won't reap the benefits of the annuity until they are, say, 85 years old. (Required minimum distributions must start at age 70-1/2.) The proposed rule would allow those dollars to be excluded from RMD calculations, as long as the annuity met a variety of requirements (for instance, payouts start no later than age 85).Your heirs may receive the money after a hefty portion has been "taxed" away or they may encourage the heirs to "roll" over the "money" into their "account". It is all a game of extend and pretend.

The Federal Reserve prints worthless fiat money. The government then swaps it for things and then you are expected to trade something of value for it - your precious time here on the earth. Then you are expected to be "responsible" and save the dung, they call money, for your "retirement."

Nobody Understands Debt - Paul Krugman

His article is here.

Mr. Krugman argued again on the first of the year that the government needs to spend more money and that spending will somehow relieve the "suffering of ordinary Americans."

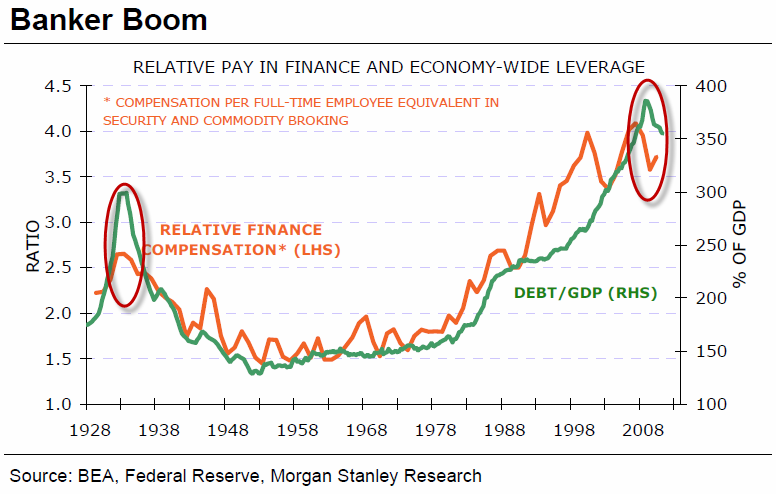

The chart above would seem to demonstrate that bankers and other workers in "finance" will suffer by virtue of less debt. The chart clearly shows the more the government borrows, the bigger the banker compensation.

I wonder who pays Mr. Krugman.

Perhaps most obviously, the economic "experts" on whom much of Congress relies have been repeatedly, utterly wrong about the short-run effects of budget deficits. People who get their economic analysis from the likes of the Heritage Foundation have been waiting ever since President Obama took office for budget deficits to send interest rates soaring. Any day now!

We all know the government has been spending money faster now than ever as demonstrated by the ever rising debt ceiling. According to Mr. Krugman we should be seeing an improving job market any day now. Have you seen any sign of it? Mr. Krugman seems to fit right in with those other "experts".

He also mentioned that "those rates have dropped to historical lows." He referenced interest rates. What does this say about the value of money? Apparently it costs nothing to get it - just look at the interest rates.

First, families have to pay back their debt. Governments don't - all they need to do is ensure that debt grows more slowly than their tax base. The debt from World War II was never repaid; it just became increasingly irrelevant as the U.S. economy grew, and with it the income subject to taxation.

Governments don't pay back their debt? Then who does? Do the creditors get stiffed?

Here Mr. Krugman reveals the real purpose of taxes. They are not to ensure services for the citizens. They are to ensure that the creditors do not get stiffed and are able to collect interest from American suckers.

Second - and this is the point almost nobody seems to get - an over-borrowed family owes money to someone else; U.S. debt is, to a large extent, money we owe to ourselves.

Now this is just stupid. Would you lend yourself money? Would you pay interest to yourself? If I could lend myself money, I would be extremely wealthy. How about you?

He closed his piece by stating we need more government spending to get out of "our unemployment trap." This is backward. Government spending will not produce jobs. Why? Because when the government spends its worthless fiat money there is no exchange of one meaningful good or service for another. The meaningless fiat only begins to have meaning after the suckers downstream from the source have worked to get it.

Basically, Mr. Krugman demonstrated government fiat money is worthless and meaningless. In the world he created there is no point to meaningful economic activity because the producer of something meaningful will get stiffed with worthless fiat issued by the Federal Reserve and backed by the American sucker - the taxpayer - errr the "full faith and credit of the U.S. goverment".

Will Ron Paul kill the caucuses? - 12/20/11

The story is here.

Here is the claim. Democrats and independents have changed their registrations, so they can get Mr. Paul nominated and then abadon him in November. I am curious why this question would not be raised if Mr. Gingrich was in the lead.

Personally, I think this shows that the primaries are a joke. The Republicans are a joke and so are the Democrats. The two party system is a joke. It is set-up so the nominees can be vetted/screened by the CFR. Anybody that really stands up for liberty and freedom and against their precious Central Bank is shut-up and locked out.

The Fed fears Mr. Paul. It wants to remain in control.

Occupy Wall Street - October 16, 2011

This movement "Occupy Wall Street" says it wants to take the country back from the banks and the corporations and yet it appears to promote the same collectivism that has brought us to where we are today.

To our understanding, Collective Thinking is diametrically opposed to the kind of thinking propounded by the present system. This makes it difficult to assimilate and apply. Time is needed, as it involves a long process. When faced with a decision, the normal response of two people with differing opinions tends to be confrontational. They each defend their opinions with the aim of convincing their opponent, until their opinion has won or, at most, a compromise has been reached. The aim of Collective Thinking, on the other hand, is to construct. That is to say, two people with differing ideas work together to build something new. The onus is therefore not on my idea or yours; rather it is the notion that two ideas together will produce something new, something that neither of us had envisaged beforehand. This focus requires of us that we actively listen, rather than merely be preoccupied with preparing our response.

I am going to be blunt. This is UTTER CRAP. These people start out by saying you have nothing without them and their bogus "group think." The new comer is immediately set up for submission - to be a sheep led to the slaughter. This is communisim.

My gut says that banksters are actually behind this supposed anti-wall street "movement".

If this group really wanted to accomplish something it would be talking about how to implement an alternative medium of exchange - an alternative to the one controlled by the banks. Remember the medium of exchange is not wealth - wealth is the things the medium of exchange makes claims against. If the bank's medium of exchange is disconnected from real wealth, they lose all power. They become empty paper bags!

Real change will come when men submit to God and His Torah. The Torah teaches that money should be honest - not the flexible crap the banks issue.

Proverbs 16

11 A just weight and balance are the LORD's: all the weights of the bag are his work.

Proverbs 20

10 Divers weights, and divers measures, both of them are alike abomination to the LORD....

23 Divers weights are an abomination unto the LORD; and a false balance is not good.

Stocks head downward - 10/13/11

So I stopped by Zero Hedge today and read that Slovakia approved the expansion of the EFSF (European Financial Stability Fund - they should just call it a bailout fund).

Slovakia Passes EFSF Expansion Vote

My immediate thought was the stock market would be encouraged and would be going up. Wrong. It is going down.

Wall Street dips on economic worries

The market had been going up earlier in the week and commentators were claiming it was due to European leaders working to prevent a European banking crisis due to a looming Greek default. Also, the economic worries have been present since July. Based upon today's news, it looks like the commentators are wrong.

Holding China to Account - October 4, 2011

You have got to love Paul Krugman. A staunch advocate of deficit spending and higher debt means greater wealth.

The dire state of the world economy reflects destructive actions on the part of many players. Still, the fact that so many have behaved badly shouldn't stop us from holding individual bad actors to account. And that's what Senate leaders will be doing this week, as they take up legislation that would threaten sanctions against China and other currency manipulators.

The United States, given its special global role, can't and shouldn't be equally aggressive. But given our economy's desperate need for more jobs, a weaker dollar is very much in our national interest - and we can and should take action against countries that are keeping their currencies undervalued, and thereby standing in the way of a much-needed decline in our trade deficit.

By what standard does he propose to judge a person a bad actor? Considering his love for paper fiat money, I doubt he has a standard by which to judge. I wonder how he proposes to weaken the U.S. dollar?

Here is Wikipedia on the monetary base:

The monetary base is called high-powered because an increase in the monetary base (M0) can result in a much larger increase in the supply of bank money, an effect often referred to as the money multiplier. An increase of 1 billion currency units in the monetary base will allow (and often be correlated to) an increase of several billion units of "bank money".

Notice the banks are allowed to pyramid on top of the monetary base.

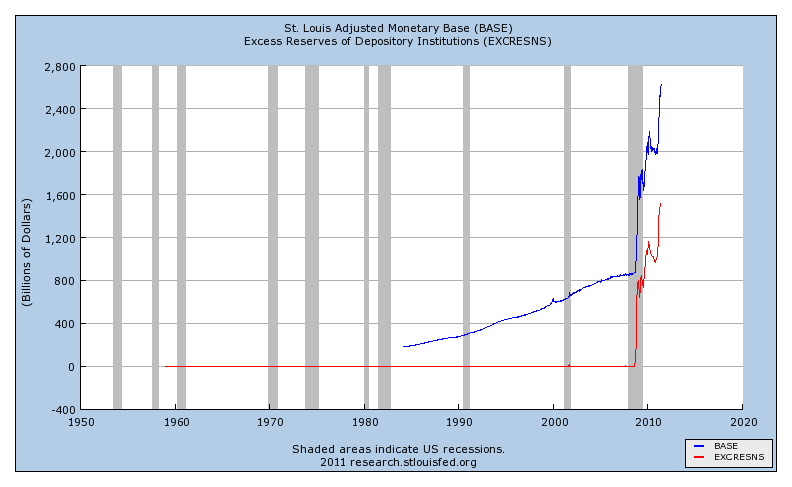

Has this man looked at the monetary base lately? If anyone is interested, it is here:

St. Louis Federal Reserve chart of the monetary base.

It looks like a hockey stick! 2010 looks like a vertical wall going up! It went from 800 billion dollars to 2.8 trillion! If that is not dilution or debasement, I do not know what is.

This is a classic case of the pot calling the kettle black. If China is a currency manipulator, what does that make the U.S.?

Here is how to avoid this type of situation - insist that any paper money you accept is backed by a physical commodity - like gold or silver, or better yet insist on gold or silver as payment - do not accept paper. The purity and the weight of the metals tendered for payment can be verified by the person accepting them in payment. The value cannot be concealed as can be the value of paper money. The value of paper money fluctuates according to the supply issued by the banks. As long was we accept worthless Chinese paper in exchange for U.S. Treasuries, we will have this problem.

Government guaranteed loans for "green" energy - September 16, 2011

The following is from an article concerning the bankruptcy of Solyndra.

"The Obama administration is in a race against the clock to close by month's end more than a dozen renewable-energy loan guarantees totaling $9 billion. Of that, just over $3 billion would come from the federal government's coffers."Article on Solyndra.

Does anyone see a resemblance here to student loans? Has anyone noticed how we are being played? This is nothing more than a scheme to give banks risk-free, federally backed loans.

- Step 1 - create fear in the population by claiming that human activity is causing global warming that will disrupt the climate.

- Step 2 - claim we can research technology that might save the day.

- Step 3 - stand at the ready with loans for that research - which will probably fail, but you will have to pay back those loans anyway.

If the market place is not investing in something, more than likely the something does not work or there is no market for the something.

At the turn of the century there were three types of automobile: 1) steam 2) electric 3) gasoline. Gasoline was chosen as the best solution by the market place. Since then neither steam nor electric has revived. The only reason there are any electric vehicles being made is government subsidies. Even if electric cars worked as well as gasoline, they would not acheive their stated purpose of cleaning up the air. They more than likely will be re-charged every night by a coal burning electric generating plant. It is the same for hydrogen fuel cells. Hydrogen does not float around free for harvest. It is made by electrolysis. Hydrogen fuel cells are essentially batteries that are charged up by electrolysis - powered by the coal fired electric plants.

I like a free and pollutionless lunch as much as the next guy. Unfortunately, they are not out there. If anybody is buying the garbage that the government backed by the friendly banksters is selling, I have a bridge to sell them.

Reminder of the Social Security Ponzi Scheme 9/15/11

In reality, Beachy had lost nearly all of his investors' money by 1998 in speculative investments such as stocks, mutual funds and junk bonds, officials said. But he continued to solicit investments from new investors, which he used to repay earlier investors -- a so-called Ponzi scheme similar to that operated by the infamous Bernard Madoff, which lost an estimated $18 billion in 2009, according to investigators. It was the largest loss in history and earned Madoff a sentence of 150 years in prison.

This is funny because it is exactly how Social Security works. New "investors" (tax payers) pay off old "investors" (retirees who used to pay taxes). This is the only way Social Security can keep going because there is nothing in the Trust Fund, but IOU's (special non-marketable government bonds). See below. The only way the Treasury can redeem the bonds is to tax "new investors". Of course the "new investors" are forced to invest. Sounds like Obamacare.

Social Security makes Bernie Madoff look like a piker.

Will Bank of America fund Rick Perry's campaign?

I wonder how long this clip will be allowed to survive?

Stock market swings wildly - 8/11/11

On Monday, 8/8/11, the DJIA plunged 630 points. I think it plunged because of data showing economic slow down and evidence that the U.S. Congress cannot control its spending.

On Tuesday, 8/9/11, with no change in control of government spending and no indication that orders for goods and services were increasing, the DJIA went up 430 points.

On Wednesday, 8/10/11, down goes the DJIA 521 points.

On Thursday, 8/11/11, up goes the Dow again - 423 points.

Either market participants are schizophrenic or this whole show is rigged and manipulated.

Six Year Olds found working on Farms - 8/11/11

Drudge had this huge headline today that linked to an ABC World News with Diane Sawyer Story about kids working on farms picking berries.

...federal investigators have found yet another disturbing example of illegal use of child labor in the berry industry.

Personally, I do not find this disturbing. From the story it looks like the children are out in the fields with their parents helping them pick.

Andrea Schmitt was quoted,

People can't make minimum wage by the piece and so if they have another set of little hands adding to the pile of berries, they might be able to make enough to live on.

What a tragedy! The family is picking up extra money and saving money on daycare costs! How dare they? How dare they teach their children the value of work? How dare they make their children into assets to the family instead of liabilities? How are those children going to learn to be good dependent consumers?

To default or not to default - that is the question. July 22, 2011

This is from Zero Hedge:

Ron Paul says default now, or suffer a more expensive crisis later.

I totally agree with Mr. Paul. We should go ahead and begin defaulting and letting interest rates rise. That will curtail our spending and borrowing. We have to slow our spending and borrowing, or we will face hyperinflation. Hyperinflation will destroy our currency and destroy the division of labor. Hyperinflation will cause violence and chaos.

I hope that Americans will not be frightened by the banksters and will stop this crazy borrowing.

Fear the Boom and the Bust - F.A. Hayek v. Keynes

Inflation? - June 8, 2011

There is debate about whether or not we are in inflationary times or deflationary times. I define inflation as an increase in the money supply. A greater money supply means more "dollars" are available to bid up prices - like for gold and oil.

Ben Bernanke denies that money printing has caused increasing commodity prices. Now, we all know that oil, gold and other commodities are up.

The Fed provides a great tool called FRED. It lets you make graphs using the Fed's different data sets.

Here is a graph I made contrasting bank's excess reserves with adjusted monetary base. The adjusted monetary base has to be balanced with Federal Reserve liabilities - ie: money. Funny how most of the new money has gone right into excess reserves.

Government Energy Subsidies - January 16, 2011

Here are some facts and figures from the U.S. Energy Information Institution.

For subsidies related to electricity production, EIA data shows that solar energy was subsidized at $24.34 per megawatt hour and wind at $23.37 per megawatt hour for electricity generated in 2007. By contrast, coal received 44 cents, natural gas and petroleum received 25 cents, hydroelectric power 67 cents, and nuclear power $1.59 per megawatt.

See Subsidizing American Energy

In light of these numbers, we must ask what is driving companies to pursue energy sources like wind and solar. I think it is obvious. It is not a long term hope of success and profit. It is the short term goal of receiving government pork. I highly doubt these subsidies are dependent upon what the company delivers and in fact the money is probably handed out before the company delivers anything.

Do you do business that way?

There is another thing to consider. Hopefully we agree that subsidies are what is driving companies to try to produce energy using wind and solar. Given that, we should assume the companies themselves have little hope that wind and solar will produce long term profits and success. If they had such hopes, no government subsidies would be needed to propel them into wind and solar. So, what happens after the subsidies have done their work and driven many producers from using coal and oil to using sun and wind? How reliable will energy delivery be? What about scarcity and demand? What will that do to prices? What about our standard of living?

Finally, as Henry Hazlitt stated in Economics in One Lesson, there are the unseen consequences of taking money from the private sector in order to subsidize wind and solar. We can only imagine what would have been done with the money and what kinds of goods and services it might have created, if it had not been taken from private hands.

Charles Hugh Smith of Two Minds.com - January 6, 2011

Mr. Smith understands the current policy of the Federal Reserve will not lead to economic recovery. Infact, it is leading to the opposite - economic depression.

He outlines five reasons here:

Items 1 and 2 are particularly interesting. This dovetails with what Mr. Hazlitt stated in the quote below. In item 1, Mr. Smith stated that when money is costly (high interest rates), productivity and capital accumulation are encouraged. In item 2, he stated when money is cheap (almost zero interest), the opposite conditions hold: productivity is discouraged, speculation and mal-investment are encouraged.

As Mr. Hazlitt established, production is equal to demand. Since the current Federal Reserve policy is discouraging production, demand will not increase in the near future and thus there will be no "real" economic recovery.

Economic "Stimulus" Only Creates Debt - not jobs. January 3, 2011

Isn't my assertion the opposite of what "great" economists, like Paul Krugman, tell us? Yes, it is the opposite.

Deuteronomy 14:23-26 tells us about money (see the post below entitled Money is a Fraud from 10/10/10).

Paul Krugman and other Keynesian economists would have us believe government spending via government borrowing will "stimulate" the economy and create jobs. Somehow the presence of fiat money will create demand for goods and services. I believe this idea is upside down. It is 180 degrees from the truth.

See Henry Hazlitt's Economics In One Lesson at page 15. He wrote:

This is inevitable when we consider that demand and supply are merely two sides of the same coin. They are the same thing looked at from different directions. Supply creates demand because at bottom itis demand. The supply of the thing they make is all that people have, in fact, to offer in exchange for the things they want. In this sense the farmers' supply of wheat constitutes their demand for automobiles and other goods. The supply of motor cars constitutes the demand of the people in the automobile industry for wheat and other goods.

So an increase in the money supply via deficit spending does not increase demand because there was no increase in production. Those pretty GDP numbers that will be reported post QE3 will be nothing but a fantasy.

Here is another illustration. The business of printing money is the largest business of all when measured in monetary terms, but all it produces is pretty slips of paper (that sometimes fold on the printing press and then have to be burned).

Check out BUYflation at Zero Hedge - October 20, 2010

The Price of Gold - What is going on? October 19, 2010

Wow! Last week was thrilling. Gold soared to $1381.20 per ounce!

So, why did this happen? Why has the price dropped back to $1333.40?

Here is my theory. On Friday Helicopter Ben Bernanke gave a speech. He really did not say what the Fed would do, but I think the market interpreted the speech as a forecast of inflation and gold responded. Here is a snippet from Helicopter Ben's speech:

Thus, in effect, inflation is running at rates that are too low relative to the levels that the Committee judges to be most consistent with the Federal Reserve's dual mandate in the longer run. In particular, at current rates of inflation, the constraint imposed by the zero lower bound on nominal interest rates is too tight (the short-term real interest rate is too high, given the state of the economy), and the risk of deflation is higher than desirable.

Gold is just another commodity. It goes up and down as the money supply goes up and down. When the money supply increases, the cost of a dollar goes down and it buys more gold. I have superimposed a 5 year chart of the gold price over a 5 year chart of the monetary base. I lined up the time scales pretty closely. Obviously the price scales do not coincide. I was not able to lay the price scale for gold over the graphic from the Fed.

You can see from the chart that gold (red line) has risen in rough correspondence to the inflation of the adjusted monetary base (blue line). The Adjusted Monetary Base peaked in February or March 2010 and has been going down since. It has declined very slightly relative to the huge expansion at the end of 2008. This expansion has also caused the dollar to fall in price relative to other currencies. Why did the price fall back yesterday. It could have been China's announcement to raise its interest rates. There was other news also and the dollar recovered a little relative to other currencies.

Which way will the Fed go? Will it inflate or sit tight?

I think that it will sit tight, but one thing is clear from Helicopter's speech and that is the Fed would like to see inflation running at about 2 percent.

Money is a Fraud - October 10, 2010

Money is a fraud? I must be crazy!

It is a fraud.

Deuteronomy 14

23 And thou shalt eat before the LORD thy God, in the place which he shall choose to place his name there, the tithe of thy corn, of thy wine, and of thine oil, and the firstlings of thy herds and of thy flocks; that thou mayest learn to fear the LORD thy God always.

24 And if the way be too long for thee, so that thou art not able to carry it; or if the place be too far from thee, which the LORD thy God shall choose to set his name there, when the LORD thy God hath blessed thee:

25 Then shalt thou turn it into money, and bind up the money in thine hand, and shalt go unto the place which the LORD thy God shall choose:

26 And thou shalt bestow that money for whatsoever thy soul lusteth after, for oxen, or for sheep, or for wine, or for strong drink, or for whatsoever thy soul desireth: and thou shalt eat there before the LORD thy God, and thou shalt rejoice, thou, and thine household,

Deuteromony illustrates the purpose of money. Money is used to represent real things in the world: a person's labor, corn, wine, oil, animals, etc. Real things were converted into money, so they could be brought from one place to another without transporting the actual objects.

This is great as long as there is no fraud involved. Enter the banks.

How do the banks bring fraud to money? It is simple. They end the conversion process described above. The Federal Reserve described this process of avoiding conversion in the booklet published by the Federal Reserve Bank in Chicago called, "Modern Money Mechanics."

You can buy this book at Amazon or you can download it from here.

Essentially the bank creates money by simply writing a check to a borrower or in payment for securities. These checks are rubber. There is not enough money or anything else of value in the bank's account to cover it.

Page 3 of the booklet asked, "Who Creates Money?" The booklet goes on to state,"The actual process of money creation takes place primarily in banks. As noted earlier, checkable liabilities of banks are money. These liabilities are customer's accounts. They increase when customers deposit currency and checks and when the proceeds of loans made by the banks are credited to borrowers accounts."

The booklet described how bank deposits expand and contract. You see that money defies the law of conservation of energy and matter. Suppose the Federal Reserve Bank of New York buys $10,000.00 of Treasury bills. The Fed pays the dealer of those Treasury bills by crediting the dealer's account at his/her bank. Do not forget the Fed did not convert anything into that $10,000.00. It created it with the stroke of a pen. That is not the end of the process.

Now our Treasury bond dealer's bank has a deposit or liability in the amount of $10,000.00 and it has reserves at the Fed in the amount of $10,000.00. That reserve is an asset and the bank's balance sheet is balanced. The bond dealer's bank is not required to keep that entire $10,000 in reserve. It is only required to keep about $1000.00 in reserve. That bank can now lend out $9000.00 that it does not really have. When it lends it out it has created two claims against it. The one from the borrower and the one from the depositer - our bond dealer, but he probably won't need it. Right?

We will assume our borrower banks at the same bank as our bond dealer. The borrower "deposits" the loan money in the amount of $9000.00 in his/her checking account. The loan is now called an asset. The bank also has its $10,000.00 reserve sitting at the Federal Reserve. Our bank now has assets in the amount of $19,000.00 and liabilities of $10,000.00 plus the new $9,000.00 deposit or $19,000.00. The bank has just created $9,000.00 out of nothing!

The whole process is actually more complex and I would refer you to "Modern Money Mechanics" for a complete description of it.

Now imagine you used that $9,000.00 that was created out of nothing to purchase a car. The bank from which you borrowed that money would have a lien on your car and if you failed to pay back the NOTHING that you borrowed, the bank would repossess your car! How is that for a deal?

Default Is In Our Stars - September 27, 2010

Here is a new piece by Paul Krugman. Default Is In Our Stars.

Here is a quote from him:

A naive view says that what we need is a return to virtue: everyone needs to save more, pay down debt and restore healthy balance sheets.

I beleive this reveals his nature very clearly. I would be very careful about loaning money to this man. I suspect he will not pay you back. I suspect his answer to his indebtness, will be to fire up the printing press and hand you a bunch of paper with no work or material goods behind it!

In my opinion, this attitude toward debt should lead to a very low credit rating.

One more thing. This notion that deflation is harmful, is ridiculous! It is precisely what is needed. We need to encourage savings, so there will be investment in productive activities. How do we encourage saving? Simple, falling prices and increasing value of money! How hard is that to understand?

That will cause pain. That is an INVESTMENT in the future, which is a laying aside of money to put into a project with the expectation of future profit.

Any athlete will tell you,

No pain, no gain.

August 28, 2010

Proverbs 22

7 The rich ruleth over the poor, and the borrower is servant to the lender.

The U.S. must be China's servant!

Time to Print, Print, Print - August 18, 2010

Today we find this article in Barron's. The author calls for the Fed to print, print, print.

They say that history repeats itself. This is an understatement at best.

I would be just as happy as the next guy, if we could turn stones into bread, but we cannot. This is a fact that we all like to ignore.

This scenario of a country trying to inflate its way out of its debts has been repeated many, many times and it has always led to disaster. Why do people continue to fall for this ploy? How can we possibly believe, "This time will be different."

We are like gamblers at the casino losing money and continuing to pull the lever.

There are many examples in history showing us not to do what this gentleman from Barron's is recommending.

You can find just one of them here.

John Law convinced the French government that it should use paper money and inflate. Like all Ponzi schemes, this one collapsed. In an effort to prop up the toilet paper currency the government made it illegal to possess precious metals and searched homes to confiscate them. Basically, when people refused to work for the worthless paper a gun was held to their head and they were told they needed to work.

Sounds like slavery to me. OK, lets print and head ourselves away from freedom and into slavery. Yahoo!

Deuteronomy on money and weights - August 18, 2010

Deuteronomy 25

13 Thou shalt not have in thy bag divers weights, a great and a small.

14 Thou shalt not have in thine house divers measures, a great and a small.

15 But thou shalt have a perfect and just weight, a perfect and just measure shalt thou have: that thy days may be lengthened in the land which the LORD thy God giveth thee.

16 For all that do such things, and all that do unrighteously, are an abomination unto the LORD thy God.

The Great Default is beginning - August 9, 2010

The New York Times says, "There's a class war coming to the world of government pensions." You can read the article here.

The gist of the article is the pensions of public employees are breaking state budgets and as a result the states are looking to break the promises made to the public employees. Some of them planned their financial futures based upon assumptions regarding their pension, which are now in danger of changing.

In my opinion this is good. If the government breaks enough promises, eventually people will lose faith in government. It is time the people of this nation lost faith in the government.

What Proverbs states about money - August 5, 2010

Proverbs 16

11 A just weight and balance are the LORD's: all the weights of the bag are his work.

Proverbs 20

10 Divers weights, and divers measures, both of them are alike abomination to the LORD.

23 Divers weights are an abomination unto the LORD; and a false balance is not good.

The U.S. dollar was once redeemable for one ounce of silver. It is no longer. It is now a diverse weight or measure

ObamaCare unconstitutional - August 2, 2010

Here is a great video of my favorite Congressman, Pete Stark.

The impressive thing about this video was the questioner started out with the premise that "health care" is a right and proceeded to demonstrate that if "health care" is a right, that right will create slavery and thus will contradict the thirteenth amendment, which abolished slavery.

Galbraith says the government has unlimited money! - August 2, 2010

I read this piece by Robert Murphy called Nonsense on the Deficit Question today.

The article was about an interview James Galbraith gave to Ezra Klein. Mr. Galbraith argued the federal deficit poses absolutely no danger to the U.S. He seems to be in the Pete Stark vein - the more the government spends the wealthier we all get.

Mr. Galbraith said,

Say I'm the federal government and I wish to pay you, Ezra Klein, a billion dollars to build an aircraft carrier. I put money in your bank account for that. Did the Federal Reserve look into that? Did the IRS sign off on it? Government does not need money to spend just as a bowling alley does not run out of points.

This view is extremely dangerous. Mr. Galbraith believes the government can have whatever it wants, just by printing or crediting someone's bank account (digits). This attitude will lead to hyperinflation. Money is a medium of exchange. It has no intrinsic value. If the government simply prints to buy an aircraft carrier or anything else - there is no exchange because the government did not produce anything of value to obtain its billion dollars. That billion dollars would simply be injected into the economy with nothing behind it other than a printing press. It will increase the money in circulation and not inrease the goods and services those dollars compete to get. Soon those dollars will be as about as valuable as the bowling alley points!

Social Security - July 30, 2010

I skimmed a piece by Ludig von Mises today called The History of Capitalism.

Mises posed a question. Who bears the burden of Social Security? The workers or the employers? The answer is the workers. The workers' take home pay is reduced by the 7.5% paid directly by them to the government and by the 7.5% "contributed" by the employer. That additional 15% could have gone right to the worker instead of to Uncle Sam.

We know that the Social Security Trust Fund is filled with nothing, but IOU's because SSA readily admits it. See the Social Security website Trust Fund FAQs. I learned there that every day money coming into the Trust Fund is imediately exchanged for non-marketable government bonds. We are told this is to increase the security of the funds because their value cannot go down! This really means these "securities" are worthless in the market place because they can only be purchased back by the U.S. Treasury. I also learned the cash obtained by the "sale" of these "special" securities goes right into the general fund of the Treasury and it becomes indistinguishable from the other "cash" that is in the fund. The only way for these securities to be redeemed by the Trust Fund is for the U.S. Treasury to either borrow money or tax it away from wage earners. This scheme is nothing more than a sleight of hand. This simply allows politicians to spend Social Security money today on whatever vote getting project they see fit to use it on.

Why aren't "special" government bonds IOU's? Of course they are IOU's! See wikipedia. A bond is nothing but a written contract that one party owes another money. How is it possible that one government agency owes another one money? Can any individual wage earner in this country owe him/herself money? No! I do not know about you, but if that were possible, I would write myself a "bond" everytime I spent money. My net worth would increase everytime I spent money! At least if anyone believed I would ever pay on those "bonds".

What is the rationale for Social Security? Mises suggested that one may argue wage earners lack the insight and/or strength to provide for their own future. My question is, "Has the government done any better?" I would venture that it has not! Social Security is a pay as you go program. It simply transfers income from people who are working to those who are not. There was no investment/savings.

Mises asked another question. If these wage earners do not have the sense to manage their own money and provide for their own future, how is it that we give them the power to vote? Is it reasonable to assign the wards the right to elect their own guardians?

The Bible says that a house divided (filled with hypocrisy) cannot stand. Does anyone think the U.S. house can stand? I don't.